1 Trillion Dollars of School Loans

– via Daily Currant –

– via Daily Currant –

President Obama announced a plan today to forgive 100% of all federal student loans in the country.

In a speech at in Scranton, PA the president told an assembled crowd that it was unfair to hold college graduates to promises they made as students and outlined his vision for ending all student loan payments by the end of the year.

“Just because someone borrowed a bunch of money doesn’t mean they have to pay it back,” he explained to a friendly crowd at Scranton University, “This isn’t 19th century England. This is America. And in America we’ve always believed in second chances.

“In today’s economy a university education is more important than ever. Where would successful people like Bill Gates, Steve Jobs, Tom Hanks, Brad Pitt or Mark Zuckerberg be without their college diplomas? These days skipping college just isn’t an option, but neither is continuing to pay for increasingly expensive tuition.

“We need colleges to teach our young people useful skills like sociology, gender studies and postmodern Moldovian claymation. But the most important thing we need to teach them is responsibility. And what better way to teach responsibility than to hold these banks accountable for the terrible loans they’ve made.”

The student loan burden in America is estimated at over $1 trillion dollars, with most of that in the federal government’s hands. There are an estimated 40 million student loan borrowers who hold an average of $24,000 of debt between them. The cost of a college education in the U.S. has risen 600% since 1980, much faster than inflation.

Although since the financial crisis the level of other types of debt such as mortgages and credit cards has fallen, student loan debt has continued to rise alarmingly. Some economists have called this trend a crisis, as heavy loan burdens discourage consumer spending and housing sales amongst the young.

Many liberal activists have called for the type of loan forgiveness Obama announced today. Conservative economists, however, have called for the government to leave the market altogether, noting that cheap government loans allow students to artificially bid up the price of higher education.

Under Obama’s plan all $900 billion in federal student loans will be wiped out on November 1st, and no further payments need be made after that date. The loss of revenue will add significantly to the U.S. government’s deficit, although the cost would be spread out over several years.

The reaction among recent college graduates to the program has so far been ecstatic. Ryan Howard, a local paper salesman and graduate of Scranton University’s MBA program says he can’t wait to have his debt forgiven.

“My wife Kelly has expensive tastes and we have another baby on the way,” he explains, “I could really use the money.”

– via People Magazine –

– via People Magazine – -via NDTV –

-via NDTV – This is what our world has come to.

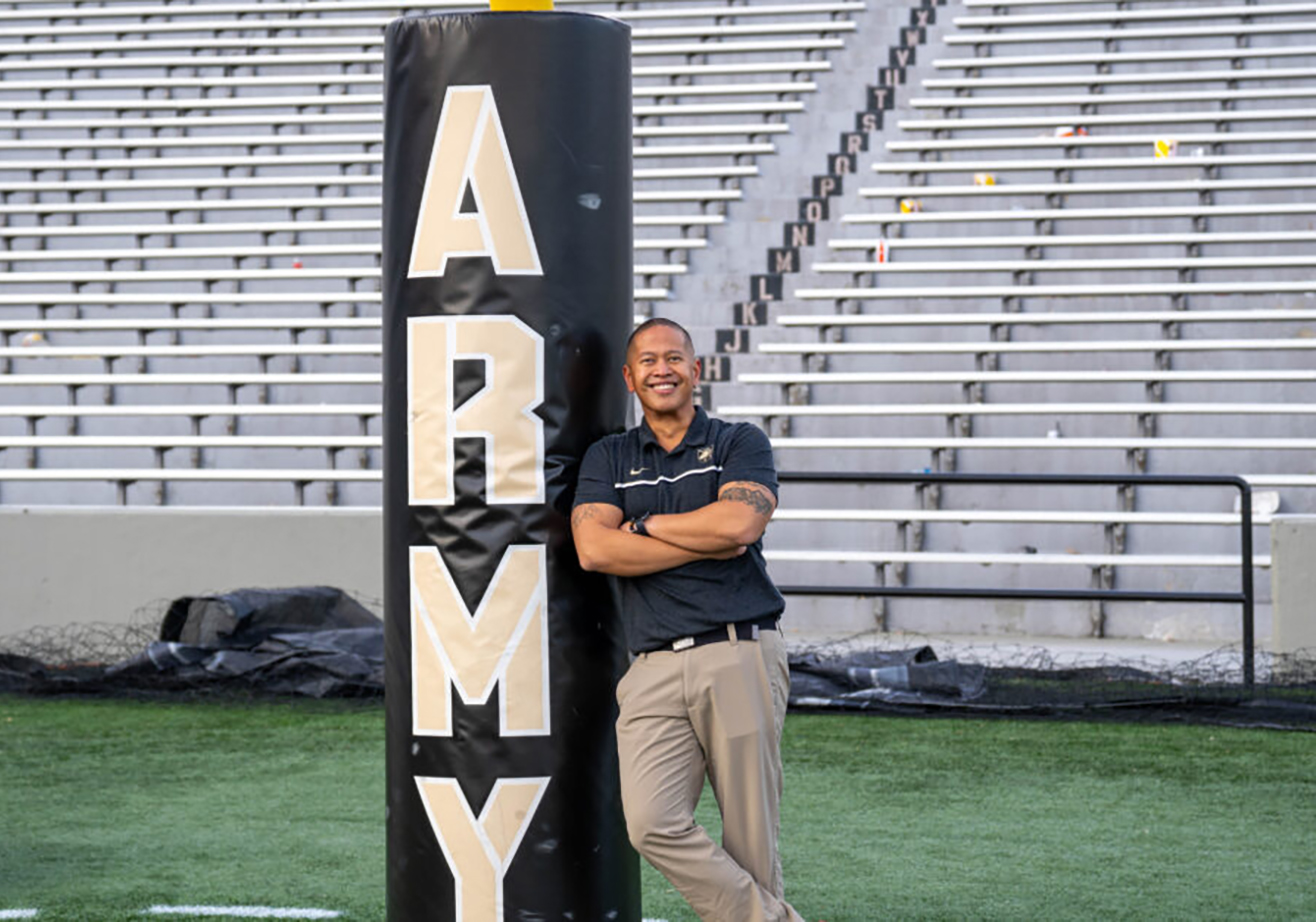

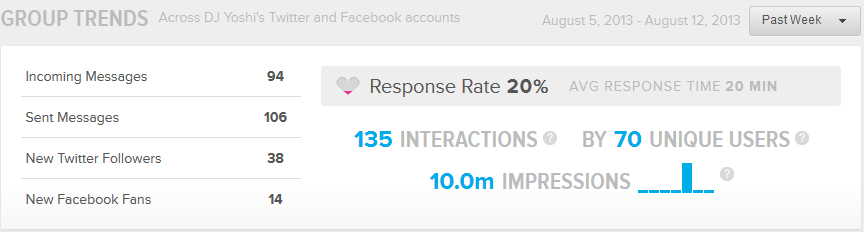

This is what our world has come to. People want to read, view, and find out more about what DJ Yoshi and the DJ Yoshi Experience is all about!

People want to read, view, and find out more about what DJ Yoshi and the DJ Yoshi Experience is all about!

New York NY To celebrate the 30th anniversary of the Video Music Awards, MTV has tapped DJ Yoshi (Official DJ: Rutgers Football & Basketball, Armadale Vodka & Full Armor Clothing) to spin at the VMA Pop-up Tour.

New York NY To celebrate the 30th anniversary of the Video Music Awards, MTV has tapped DJ Yoshi (Official DJ: Rutgers Football & Basketball, Armadale Vodka & Full Armor Clothing) to spin at the VMA Pop-up Tour.